how much is mass meal tax

The calculator will show you the total sales tax amount as well as the. How is meal tax.

Taso S Euro Cafe Menu In Norwood Massachusetts Usa

The sale of food products for human consumption is.

. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. The states room occupancy excise tax rate is 57.

This page describes the taxability of. A state sales tax. The state meals tax is 625 percent.

The base state sales tax rate in Massachusetts is 625. The meals tax rate is 625. The tax is 625 of the sales price of the meal.

You have reached the right spot to learn if items or services purchased in or. How much is tax on food in Massachusetts. Note that while the statute provides for a 5 rate an uncodified surtax adds 7 to that rate.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 52 rows The table below lists the sales tax and meals tax in the 50 US.

Hotel rooms state tax rate is 57 845 in Boston Cambridge Worcester Chicopee Springfield and West Springfield A local option. The sales tax imposed on a meal is based on the sales price of that meal. A local option for cities or towns.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. Massachusetts local sales tax on meals. A local option meals tax of 075 may be applied.

Exemptions to the Massachusetts sales tax will vary by state. A product that costs more than. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

Pay Sales or Use tax Form ST-6 or Claim an Exemption Form ST-6E with MassTaxConnect. A state excise tax. The tax is 625 of the sales price of the meal.

The cost of a Massachusetts Meals Tax Restaurant Tax is unique for. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. In general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income tax.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor. The tax is levied on the sales price of the meal. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625.

The Massachusetts sales tax is imposed on sales of meals by a restaurant. Sales tax on meals prepared food and all beverages. Most food sold in grocery stores is exempt from sales tax entirely.

Our calculator has recently been updated to include both the latest. Clothing purchases including shoes jackets and even costumes are exempt up to 175. How much is a typical meals tax.

The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. In addition to the state.

Here S What You Can And Can T Buy Tax Free In Mass This Weekend Wbur News

Meals Tax Holiday Proposed For Mass State Budget

When Is Tax Free Weekend In Massachusetts Nbc Boston

Vesuvius Salem Menu In Salem Massachusetts Usa

The Mass Sales Tax Holiday Returns This Weekend Here S Everything You Need To Know

Mass Sales Tax Holiday Weekend Dates Set For 2022

How Do State And Local Sales Taxes Work Tax Policy Center

Real Time Sales Tax Collection Proposal Would Inflict New Costs On Business Provide No New Revenue To The State

4 Ways To Calculate Sales Tax Wikihow

Our Menu Evergreen Chinese Restaurant

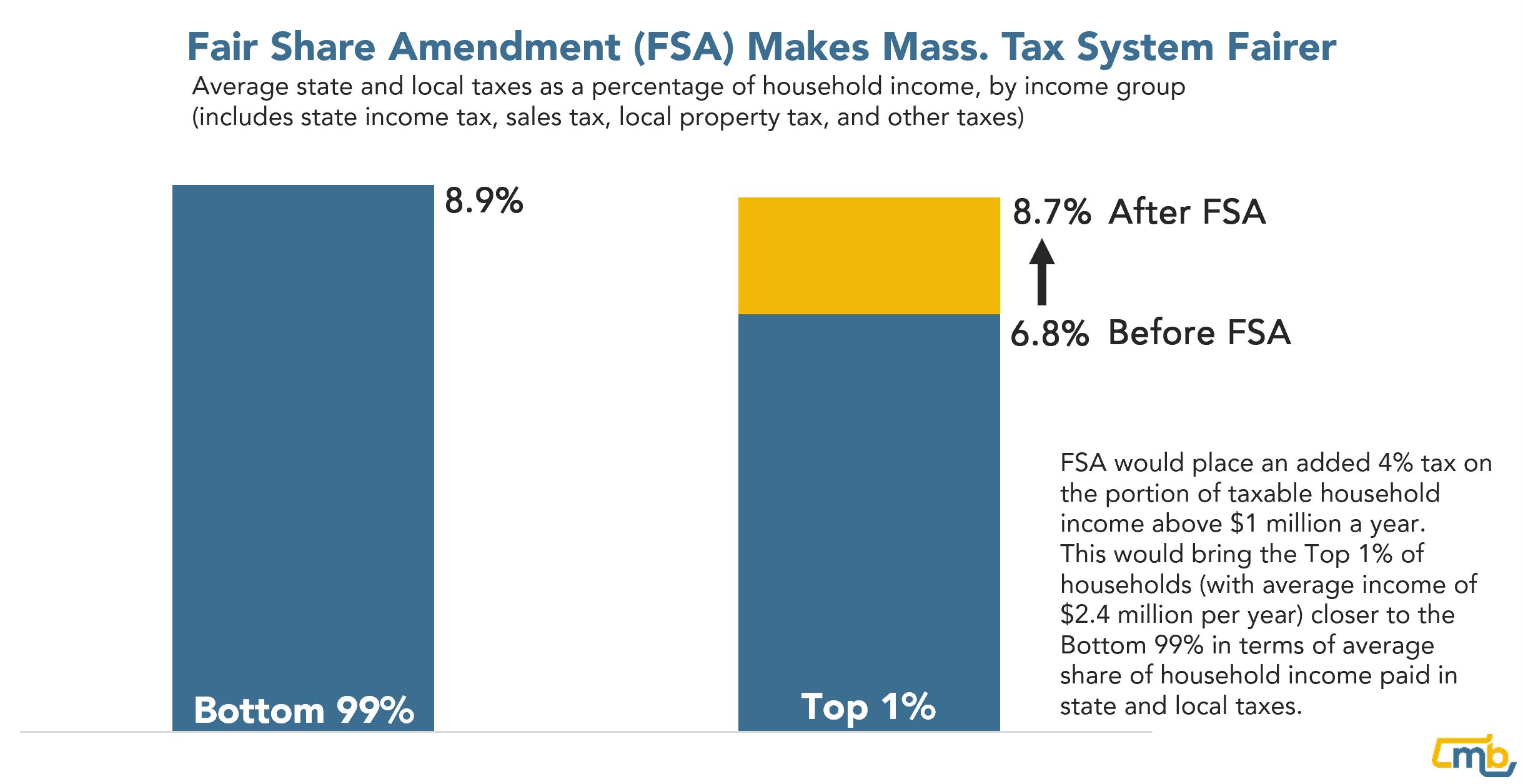

Millionaire Tax Would Make Massachusetts Tax System Fairer Mass Budget And Policy Center

Massachusetts Eying Sales Tax On Internet Purchases To Make Up For Millions In Lost Revenue From Declining Retail Sales Masslive Com

Form St Er Fillable Application For Sales Tax Exemption Renewal For Non Profit Organizations

How Do State And Local Sales Taxes Work Tax Policy Center

Meals Taxes In Major U S Cities Tax Foundation

How To File And Pay Sales Tax In Massachusetts Taxvalet

Kevin Mass Food Tax Isn T A Math Problem It S A Moral Problem